This is Queen’s Quest, a newsletter about Finance/Politics

Just like everyone, I’ve been fascinated by the Musk offer to buyout Twitter. I believe there is a lot at stake here. Much more than pundits are currently considering. First I wondered if Musk was trying to drive the price of Twitter up, or maybe he was driving it down? Was it a ploy to drive down Digital World Acquisition Corp. (DWAC) dealing a blow to Truth Social (down about 25% since the announcement of Musk’s passive-aggressive acquisition)? But before we had a chance to consider all of these musings, MAGA pundits raced towards a single narrative. In an information war, we’ve seen racing towards a single narrative has been unwise.

And frankly that single narrative doesn’t ring true to me. The MAGA Community (of which I belong) have walked lockstep in certainty that Twitter’s Board of Directors will be sued, and that pressure will make Musk successful in his bid. I’ve steadfastly said, I don’t think so. This is not a slam dunk by Musk- not even after today’s announcement of his tender offer bypassing the board and made directly to shareholders. It requires Twitter’s stock to trade sideways for too long. Just look at a Twitter chart, it’s a highly volatile stock.

I have been saying almost since the beginning, there will be no lawsuits filed against Twitter’s board for violating their fiduciary responsibility. Why? “THE MATH IS UNDENIABLE!”, they say. Well, no, not really. The valuation of Twitter has not been settled at all. There are financial analysts on record saying Twitter is worth twice as much as Musk is offering. Here’s an excerpt from a financial newsletter from tech investor Jeff Brown, and whether you agree with his valuation analysis or not, he’s on point detailing Musk’s propaganda.

Musk’s argument as to why it’s a “high price” is based on the offer being a “54% premium over the day before I began investing in Twitter.” It’s on this point that Musk is just positioning.

The January lows this year had nothing to do with Twitter, and everything to do with the market-wide volatility resulting from horrendous monetary policy, the looming threat of increasing inflation, and a hawkish Federal Reserve implying large rate hikes throughout 2022.

In that sense, Musk’s anchor to the January lows is arbitrary. It doesn’t relate to Twitter’s present and future valuation.

Twitter is easily worth double where it is trading today, and worth even more if Musk is successful in taking the company private.

If it were me sitting on Twitter’s board, I would say no to the deal at $54.20 a share… It doesn’t make sense. And I’m sure the board will reject his initial offer. Brown Research

Yet, Twitter DID NOT REJECT Musk’s offer. Brown goes onto say that Twitter does need improving, and maybe Musk is the one to get the job done, but he advises Musk to make a more serious offer based on current valuations. But who cares right? Twitter stock price has been in the toilet, Goldman has a sell rating and target for $30, therefore it’s only worth its market capital, and the extra $7Billion offered as a premium. What’s missing?

T I M E. There is a time aspect to equity markets, that people inexperienced in the market do not understand. Time in derivatives, time on price targets, time for earnings announcements and FUTURE guidance… time, Time, TIME. And that’s all the Twitter board has bought themselves- some time. People who are downright angry at me for daring to have my own opinion and weighing in on the offer, are saying, “The board has said no to a shareholder’s vote!” However, I can’t find that anywhere. All the Twitter board has said is, “not so fast”. They didn’t reject the offer, they didn’t say shareholders would never vote, they simply instituted the shareholder’s rights strategy “poison pill”, and even that has a limited duration (time). They have simply bought Twitter time. Anyone filing suit at this time, would be laughed out of court trying to prove that action wasn’t prudent.

Also consider the time to make a decision, file a lawsuit with evidence, etc. All this “time”, may be a strategy to allow Twitter price to go up. The buyers’ interest to purchase the company make this more likely than not. The more interest Musk and others show in buying Twitter, the higher they push up the stock price. It’s a very delicate tightrope Musk walks. And if Twitter hits $54.20 per share, Musk’s offer is moot. Investors can sell their shares on the open market, not wait until a deal can be made with Musk. And if Twitter can get a better deal, wouldn’t that be in the best interests of shareholders?

Legal experts, professors of law, in these cases are warning the litigious world of The Business Judgment Rule. The business judgment rule protects boards of directors in such lawsuits and here is the criteria (from Cornell Law):

In suits alleging a corporation's director violated his duty of care to the company, courts will evaluate the case based on the business judgment rule. Under this standard, a court will uphold the decisions of a director as long as they are made (1) in good faith, (2) with the care that a reasonably prudent person would use, and (3) with the reasonable belief that the director is acting in the best interests of the corporation.

Oh wait! There is nothing here about the best interests of the shareholders. It says best interests of the corporation. Interesting. I recently read a rumor that Pfizer was considering delisting its stock, due to vaccine controversies. It doesn’t appear to be true, but it brings up an interesting question: what if a public company delists its stock? What about its shareholders?

It’s too bad so sad.

The company can take it private regardless of shareholders “interests”. This is what Musk is proposing, and I daresay, there are many stakeholders that have much more flexibility in trading Twitter and its derivatives, and don’t want the limitations of Twitter as a private company- where trading stock is subject to approval. The interests of a shareholder and what investors want is not considered and is part of the risk in buying company issued stock. Investing in stock is not always a profit-making certainty, especially on any given day (time). But let’s hear what the legal experts say about DeSantis’ threat to sue Twitter:

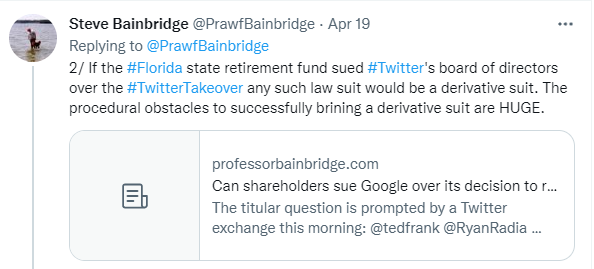

This brings up a very interesting point. I’ve made this point several times, on various different Telegram chats. Twitter stock is held by institutions at the rate of 80%. That’s the highest percentage of institutional holdings for any Big Tech company I’ve found. By contrast, Musk’s Tesla is held by institutions at 43%. According to Bainbridge’s thread, 80% of Twitter’s stakeholders have to clear the legal hurdles of points #1 and #2. Twitter stock that’s held in all these different funds is a derivative of the financial funds these institutions sell to investors. Individual investors of Twitter who think they can sue them-even a class action lawsuit if it survives- will have to clear legal hurdle of the business judgment rule, and that rule is deliberately elusive to protect boards.

Like I said earlier, Musk walks a very fine line. If the stock price increases too much, it will meet and/or possibly exceed his bid. If he trashes it, and the stock price dives, he may not want to pay $54.20/share. There’s no concern about his personal investment in Twitter, there are ways he could mitigate a loss, especially if he knows he’s going to cause the decline. And those on the left making statements that he won’t tank it because of his personal investment are full of it. That’s why Twitter wanted him on the board, so they could bridle him. So, what is the true purpose of all of this?

We need more time, and more clues to formulate an articulate theory, and not be so quick to believe in unison the first ideas that please us. Just today, Netflix- on the heels of a terrible quarterly report AND Musk’s tweet telling the world that Netflix’s woke culture is making it unwatchable- lost over 1/3 (36%) of its stock price at close. To be sure, he’s up to something, and I believe it is MUCH bigger than just taking over Twitter. By the end of this we may dub him, Elon the Destroyer.